What is a Medicare Supplement?

Medicare Supplements, also known as Medigap policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare. When you have a Medigap policy, Medicare pays up to its limit on your medical expenses. Then, your Medicare Supplement plan starts to help with covering costs up to the plans limit. That limit usually covers what Medicare didn't, however, that will depend on which policy you select.

What do Medicare Supplements cover?

Original Medicare covers only 80% of your Part B expenses, leaving you responsible for the remaining 20% unless you have a Medicare Supplement policy, also known as Medigap. Without this coverage, a prolonged hospital stay or costly outpatient treatments could lead to significant out-of-pocket expenses.

Medicare Supplement plans help cover that 20%, providing financial protection and peace of mind.

Is there anything not covered by Medicare Supplement Plans?

• Routine dental, vision, and hearing exams

• Hearing aids and related services

• Eyeglasses or contact lenses

• Long-term care or custodial care

• Retail prescription drugs

See Which Plans are in Your Area Today

What are the different plans?

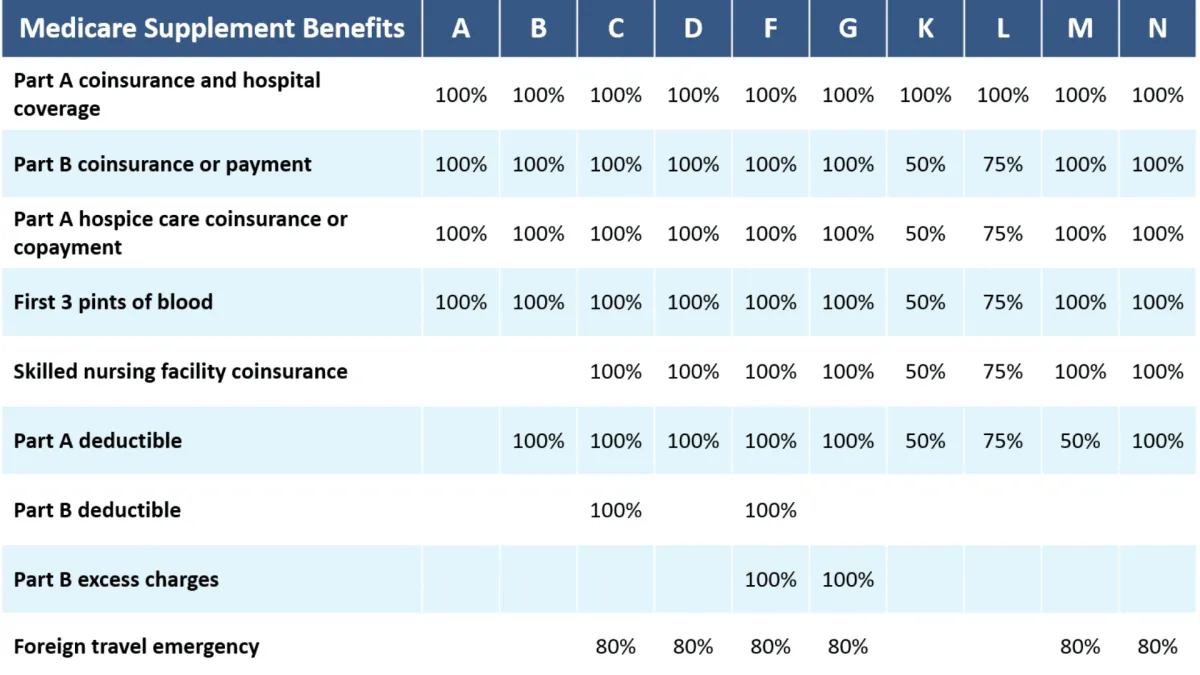

Different Medicare Supplement plans are labeled with a different letter between A through N.

Medicare Supplements feature different benefits. However, each plan must have the same standardized coverage no matter which insurance company you purchase the plan from.

Which Medicare Supplement plan should I choose?

Some Medicare beneficiaries want a plan that covers everything so they don’t have to worry about out-of-pocket expenses. Others simply want some of their deductibles and copays paid for but are mostly worried about low premiums. Ultimately, the choice is up to you.

Which Medigap policy has the highest coverage?

Medicare Supplemental Plan F has the highest level of coverage. It pays for all of your cost-sharing on covered services so you have no out-of-pocket expenses.

Medicare Supplemental Plan G is the second-best in terms of coverage. The only thing not covered is that you still pay the Part B deductible once per year. This keeps your Medigap premium lower and, in turn, may save some beneficiaries some money in the long run.

Medicare Supplement Standardized Plans

When can I enroll in Medigap insurance?

Once you have Medicare Part B, you have six months to enroll in a Medicare Supplement plan with no health questions. This is a one-time open enrollment in which you cannot be turned down for any health conditions, you cannot be asked any medical questions, and you cannot be charged an additional premium for health reasons.

However, once this one-time enrollment is over, insurance companies can begin to refuse you based on health.

This is why open enrollment is an important time to remember.